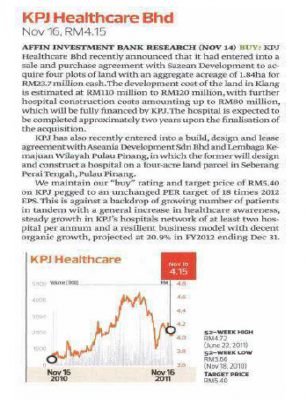

![]() Nov 16, RM4.15 Nov 16, RM4.15

AFFIN INVESTMENT BANK RESEARCH (NOV14) KPJ Healthcare Bhd recently announced that it had entered into a sale and purchase agreement with Sazean Development to acquire four plots of land with an aggregate acreage of 1.84ha for RM23.7 million cash.

The development cost of the land in Klang is estimated at RM110 million to RM120 million, with further hospital construction costs amounting up to RM80 million, which will be fully financed by KPJ.The hospital is expected to be completed approximately two years upon the finalisation of the acquisition.

KPJ has also recently entered into a build, design and lease agreement with Aseania Development Sdn Bhd and Lembaga Kemajuan Wilayah Pulau Pinang, in which the former will design and construct a hospital on a four-acre land parcel in Seberang Perai Tengah, Pulau Pinang.

We maintain our "buy" rating and target price of RMS.40 on KPJ pegged to an unchanged PER target of 18 times 2012 EPS. This is against a backdrop of growing number of patients in tandem with a general increase in healthcare awareness, steady growth in KPJ’s hospitals network of at least two hospital per annum and a resilient business model with decent organic growth, projected at 20.9% in FY2012 ending Dec 31.

|

Copyright © KPJ Healthcare Berhad. All Rights Reserved.

Copyright © KPJ Healthcare Berhad. All Rights Reserved.