The Star - Amid all the negative news surrounding the stock market, there is one counter worth looking at. KPJ Healthcare Bhd’s recent acquisition of a profit-making specialist medical centre - Pusat Pakar Kluang Utama (PPKU) -“ in Johor could prove to be a catalyst for its stock.

The 30-licensed-bed medical centre, which made a net profit of RM1.39mil for the financial year ended June 30, 2007, is expected to enhance KPJ’s future income stream.

An analyst says the RM12mil that KPJ paid for the medical centre is fair and is in line with the group’s objective to expand its hospital network to locations with a growing demand for private healthcare services.

Being in a recession-proof industry, KPJ is expected to be able to withstand the impending economic downturn. A research house believes the local healthcare sector presents many untapped opportunities.

Trading at an undemanding price-earning ratio (PER) of 7.1 times, KPJ is considered the cheapest healthcare stock in the region, where the average PER ranging from 13 to 25 times. By Cecilia Kok

Technical analysis

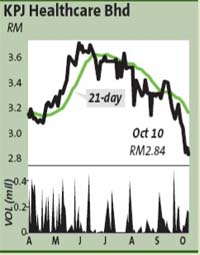

KPJ Healthcare Bhd fell to a near 14-month low of RM2.68 on Thursday before rebounding to trade marginally above the RM2.80 level yesterday.

Based on the daily bar chart, the shares enjoyed strong support at the RM2.55 level previously and chances are great they may be able to hold above this important line this time around, simply because there is no evidence of unusual selling activity in this counter despite a meltdown on the broader market front.

Apparently, the oscillator per cent K and the oscillator per cent D of the daily slow-stochastic momentum index were inching up from the bottom after flashing a short-term buy at the extreme oversold area on Thursday.

However, the 14-day relative strength index was neutral.

Meanwhile, the daily moving average convergence/divergence indicator continued to expand negatively against the daily signal line to retain the bearish note.

On the back of the tricky technical reading, we reckon prices may channel sideways until a clearer picture emerges but investors can consider accumulating some, especially on weakness.

To the upside, prices are likely to encounter still resistance at the RM3 mark, followed by the 21-day simple moving average of RM3.14.

Trailing stop-loss exit is set at the RM2.50 line to avoid a whipsaw, meaning false breakdown. - By K. M. Lee

The comments above do not represent a recommendation to buy or sell.

|

Copyright © KPJ Healthcare Berhad. All Rights Reserved.

Copyright © KPJ Healthcare Berhad. All Rights Reserved.