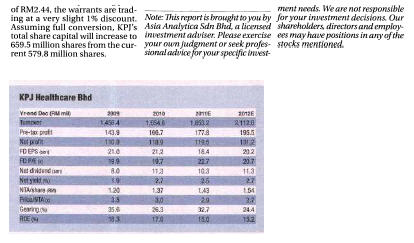

![]() In our previous piece, we out-lined the relative resilience and steady growth prospects for the healthcare industry in the country. As the leading private healthcare provider, KPJ Healthcare (RM4.18) has a multipronged strategy to sustain growth. In our previous piece, we out-lined the relative resilience and steady growth prospects for the healthcare industry in the country. As the leading private healthcare provider, KPJ Healthcare (RM4.18) has a multipronged strategy to sustain growth.

Plans to add one or two hospitals per year

For the near to medium term, it plans to add one or two hospitals to its network every year. This is on top of expansions to the bedding capacity, facilities and range of services offered at existing hospitals in lockstep with demand growth.

It successfully acquired the Sibu Specialist Medical Centre in Sarawak in April. Construction of the Bandar Baru Klang Specialist Hospital is underway and the first phase is slated for completion by end-2011.

Two smaller hospitals in Muar and Pasir Gudang are planned for 2012. Additionally, construction for a new hospital building in Kota Kinabalu is currently underway. Upon completion by2012, the Sabah Medical Centre will be relocated from its existing facility to the new building.

Recall that KPJ acquired a 51% stake in Sabah Medical Centre in June 2010 for RM51 million.Looking slightly further ahead, KPJ has plans for two other hospitals, the first of which is a 70:30 joint venture with Pasdec Corp.Construction work for this hospital in Tanjung Lumpur, Kuantan, is slated to finish in 2013.

The second is a 60:40 joint venture with Yayasan Islam Perlis in Perlis, and construction is targeted for completion in 2014. The company is also in preliminary discussions to set up a 400-bed hospital project in Bandar Datuk Onn, near Johor Bahru.

The network expansion will translate into greater economies of scale, for instance in terms of the implementation of common systems and processes as well as centralised purchasing of equipment and medication. Capital expenditure is estimated to total roughly RM150 million to RM200 million per annum.

The company is also exploring opportunities in providing healthcare business development and hospital management expertise to other providers overseas, in management or consultancy capacities on the back of its experience and track record.

Longer term venture in retirement village and aged care facilities

For the long-term, there are plans to diversify into new market segments such as retirement villages and aged care services. With Malaysia forecast to reach the stage of ageing population by 2015, demand for affordable retirement homes that include quality medical and nursing care is expected to be on the rise. Retire-ment healthcare for the elderly is already a huge income generator in many developed nations today.

In this respect, KPJ is in the midst of acquiring a 51% stake in Jeta Gardens, which owns and operates a 64-acre (25.6ha) retirement village in Queensland, Australia. Whilst earnings contribution is expected to be minimal, the company intends to gain valuable insights and experience from this venture, a business model it hopes to emulate locally.

Expanding education arm

At the same time, the company is rolling out plans to develop its education arm, KPJ International University College of Nursing and Health Sciences, into a leading centre for nursing and medical-related studies in the country.

Aside from being an additional source of revenue, the college will provide a steady stream of qualified and capable nursing and support staff to its growing network of hospitals and retirement homes venture, if all goes to plan.

The company intends to spend some RM20 million to expand its main campus in Nilai, Negeri Sembilan over the next four to five years.It aims to achieve full university status by 2016, complete with its own medical school and student capacity reaching 10,000. Currently, the university college has a capacity of about 2,500 students.

Sale and leaseback structure keep balance sheet asset-lightTo fund the expansion plans we expect KPJ will continue to inject assets into 49%-owned associate, Al-’Aqar KPJ REIT. This will keep its balance sheet asset-light and allow the company to focus on its key strength, which is hospital management. Gearing stood at a modest 30% at end-June 2011.

Since 2006, a total of 20 investment properties, including the nursing college, valued at some RM943 million have been injected into the REIT. KPJ is currently finalising the sale of three more hospital buildings to Al-’Aqar valued at a combined RM139 million. The exercise is slated for completion by end-2011 once construction of the new Bandar Baru Klang Specialist Hospital is completed.

The company will receive some 56.6 million units in Al-'Aqar worth roughly RM62.3 million at the current unit price of RM1.10 as part payment. It could distribute these units to shareholders as dividends in specie or sell

|

Copyright © KPJ Healthcare Berhad. All Rights Reserved.

Copyright © KPJ Healthcare Berhad. All Rights Reserved.