KPJ Healthcare Berhad

A leader in Malaysia's challenging healthcare services industry

- /

- KPJ Events

- News Detail

News Detail:

KPJ's multi-pronged growth strategy |

||

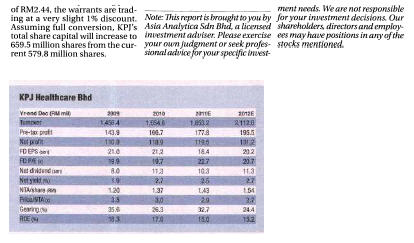

In our previous piece, we out-lined the relative resilience and steady growth prospects for the healthcare industry in the country. As the leading private healthcare provider, KPJ Healthcare (RM4.18) |

||

| 14-10-2011 | ||

|

||

|

BACK

Quick Links

Corporate Profile

Speciality Centres

Site Links

- View More

Copyright © KPJ Healthcare Berhad. All Rights Reserved.

Copyright © KPJ Healthcare Berhad. All Rights Reserved.Powered by: D Economy System Sdn Bhd